For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it’s important to...

Buying

Mandy Gulley, Real Estate AgentPre-Approval Is a Critical First Step on Your Homebuying Journey

If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few...

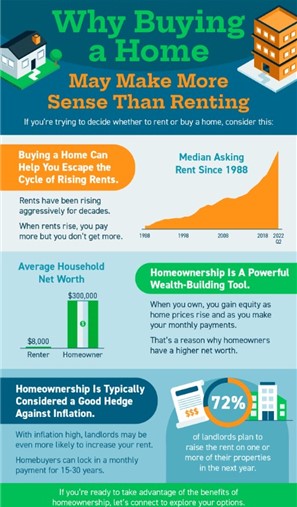

Why Buying a Home May Make More Sense Than Renting

Some Highlights If you’re trying to decide whether to rent or buy a home, consider the advantages homeownership offers. Buying a home can help you escape the cycle of rising rents, it’s a powerful...

Three Things Buyers Can Do in Today’s Housing Market

It’s clear the 2022 housing market has been defined by rising mortgage rates. With rates on the rise, it’s also become more costly to purchase a home. According to the National Association of...

A Window of Opportunity for Homebuyers

Mortgage rates are much higher today than they were at the beginning of the year, and that’s had a clear impact on the housing market. As a result, the market is seeing a shift back toward the range...

What are the Best Options for Today’s First-Time Homebuyers

First-time home buyers, you’re likely balancing several factors. Because both mortgage rates and home prices have risen this year, it costs more to buy a home than it did even just a few months ago....

Why Inflation Shouldn’t Stop You from Buying a Home in 2022

If you’re following along with the news today, you’re probably hearing a lot about record-breaking home prices, rising consumer costs, supply chain constraints, and more. And if you’re thinking about purchasing a home this year, all of these inflationary concerns are likely making you wonder if you should wait to buy.

Avoid the Rental Trap in 2022

Are you one of the many renters thinking about where you’ll live the next time your lease is up? Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.

The Perks of Putting 20% Down on a Home

If you’re thinking of buying a home, you’re probably wondering what you need to save for your down payment. Is it 20% of the loan, or could you put down less? While there are lower down payment programs available that allow qualified buyers to put down as little as 3.5%, it’s important to understand the many perks that come with a 20% down payment.

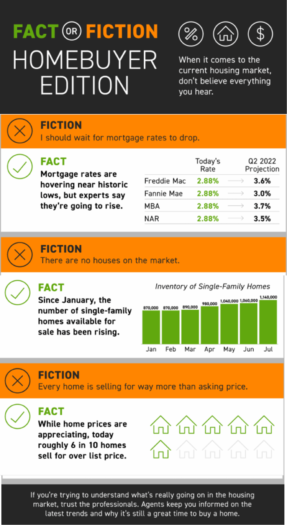

Fact or Fiction: Homebuyer Edition

It takes professionals who study expert opinions and data to truly understand the real estate market and separate fact from fiction.

Trust the pros. Reach out to an agent today to see why it’s still a good time to buy.

The Community and Economic Impacts of a Home Sale

If you’re thinking of buying or selling a house, chances are you’re focusing on the many extraordinary ways it’ll change your life. What you may not realize is that decision impacts people’s lives far beyond your own. Home purchases and sales are significant drivers of economic activity.

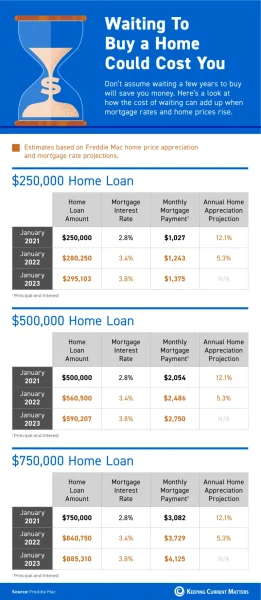

Waiting To Buy a Home Could Cost You

If you’re thinking of buying a home but wondering if waiting a few years will save you in the long run, think again.

The longer the wait, the more you’ll pay, especially when mortgage rates and home prices rise